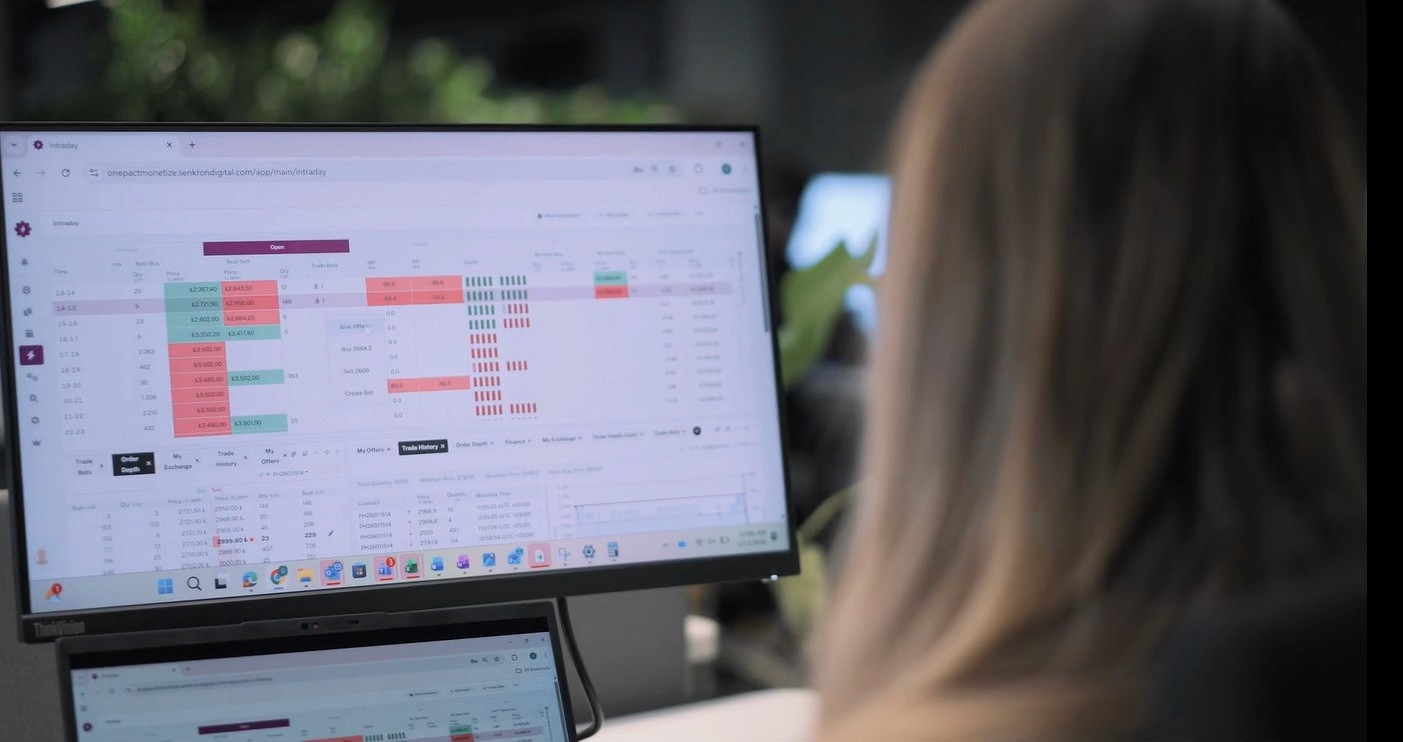

ONEPACT MONETIZE

Control for trading teams. Continuity for market operations.

OnePact Monetize brings execution, dispatch alignment, and market participation into a unified trading environment. It consolidates multiple markets into a one workflow and helps teams manage imbalances, support aggregation, and respond faster without disrupting operations.

Built for how trading teams work day to day

Built for how trading teams work day to day

Monetize serves the teams, markets, and functions that keep power flowing and portfolios balanced

Who Uses It

Teams on the frontlines of energy markets

Energy trading, dispatch and supply teams

Portfolio and risk management teams

Aggregators

Market Coverage

Active across all major energy trading markets

Day-ahead market

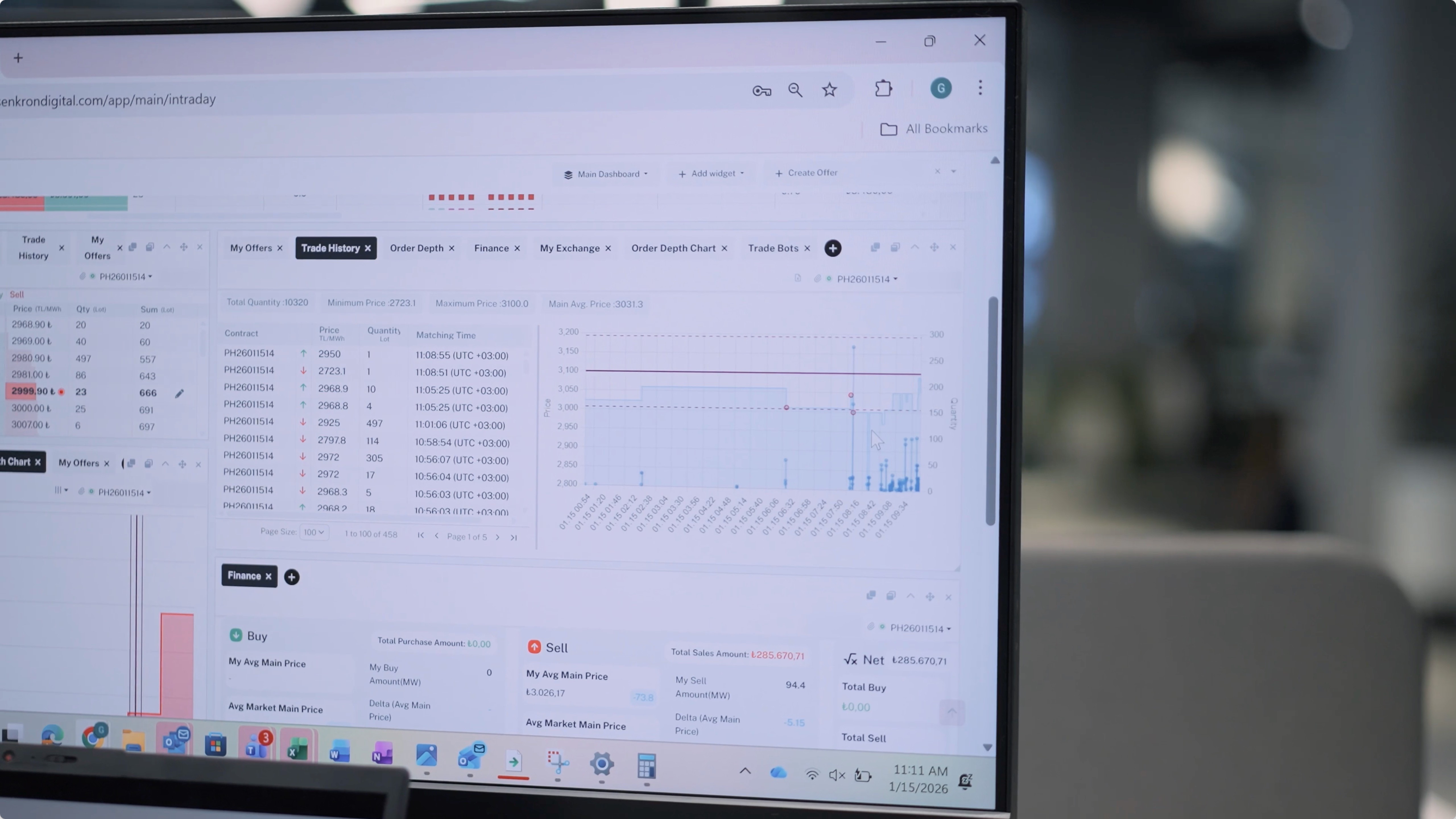

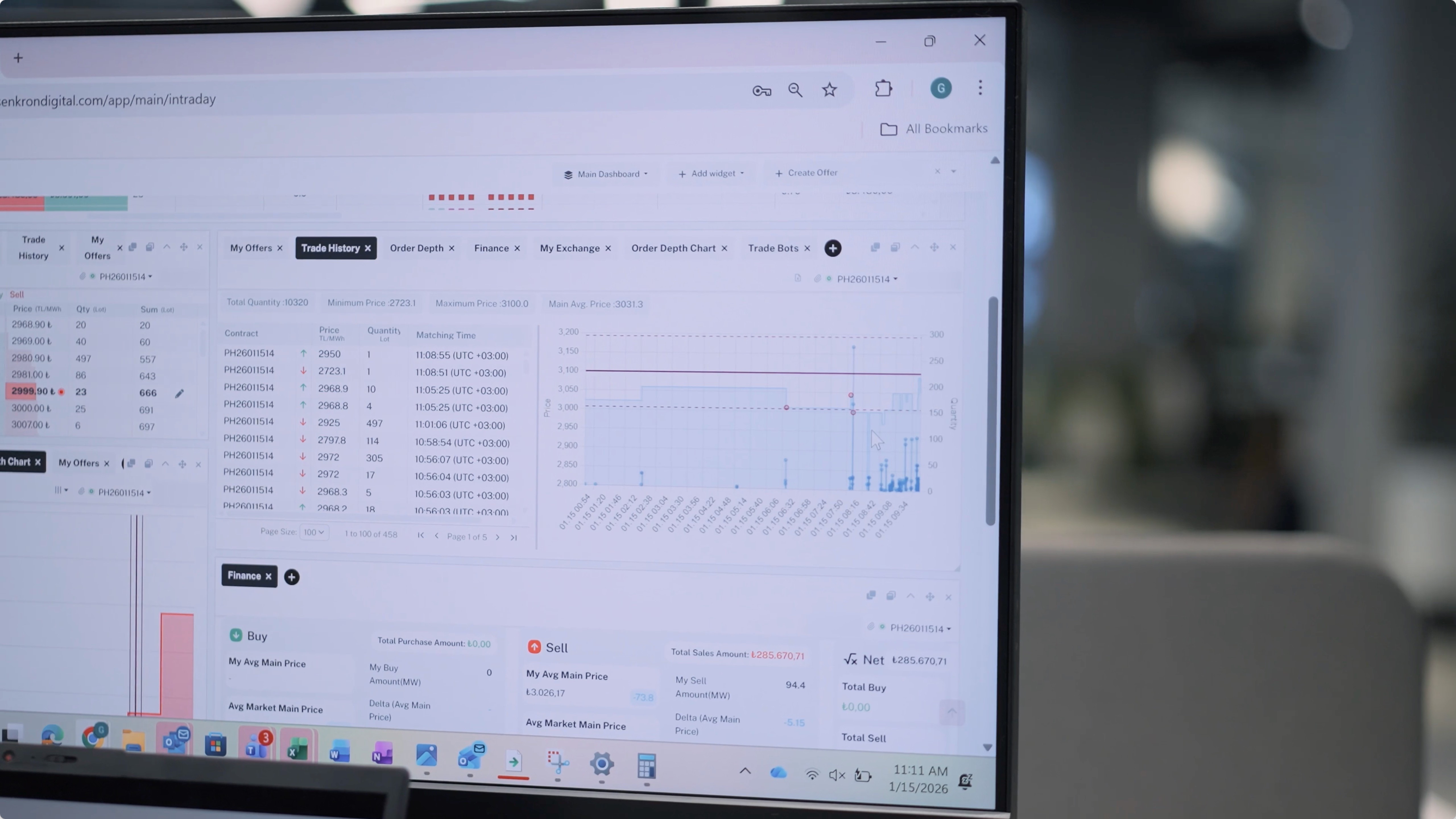

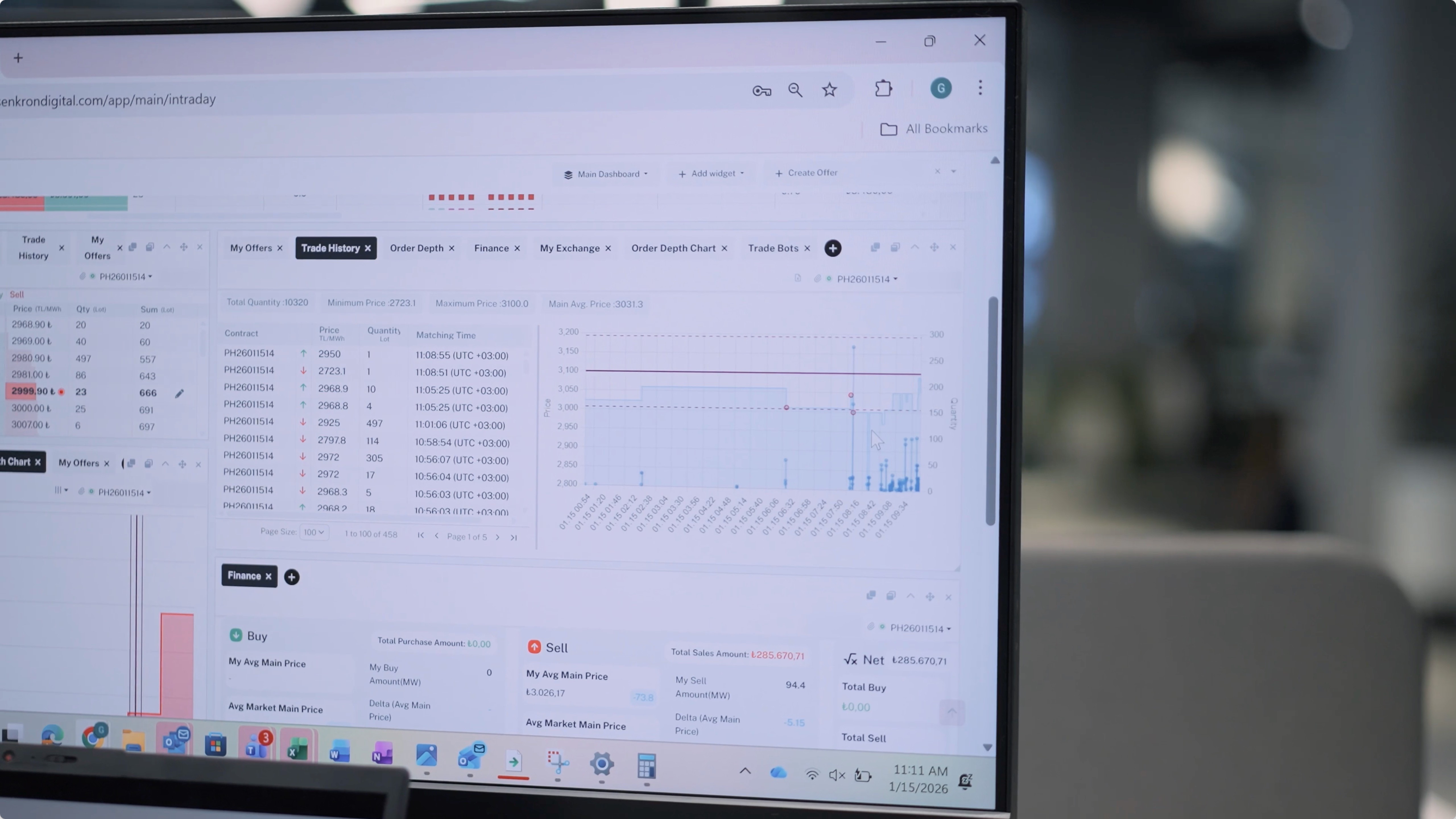

Intraday market

Aggretators

Responsibilities it supports

From bid to balance, Monetize handles everything

Financial portfolio management

Trading and dispatch coordination

Aggregation and multi-asset operating models

Operational control and balancing management

Fast markets demand faster thinking.

Fast markets demand faster thinking.

See OnePact Monetize in action

Capabilities tailored for tight trading windows

Operational speed, across markets

Operational speed, across markets

Keep day-ahead, intraday, and balancing workflows aligned in one environment

Keep day-ahead, intraday, and balancing workflows aligned in one environment

Reduce handoffs that create execution risk and operational overhead

Reduce handoffs that create execution risk and operational overhead

Move between market layers with clearer visibility and tighter control

Move between market layers with clearer visibility and tighter control

Unified workspace for balancing operations

Unified workspace for balancing operations

Dedicated interfaces for balancing energy market operations

Dedicated interfaces for balancing energy market operations

Clear separation between energy trades and balancing obligations

Clear separation between energy trades and balancing obligations

Real-time visibility of accepted balancing volumes

Real-time visibility of accepted balancing volumes

Alignment with market-specific balancing mechanisms

Alignment with market-specific balancing mechanisms

Automated submissions and dispatch coordination

Automated submissions and dispatch coordination

Reduce manual steps with automated submissions and scheduled workflows

Reduce manual steps with automated submissions and scheduled workflows

Maintain control through validation and monitoring layers

Maintain control through validation and monitoring layers

Keep dispatch coordination aligned with market commitments

Keep dispatch coordination aligned with market commitments

Trading bots and operational automation

Trading bots and operational automation

Apply trader-defined strategy and rules for consistent execution

Apply trader-defined strategy and rules for consistent execution

Use a bot library, or build bots using your own algorithms

Use a bot library, or build bots using your own algorithms

Define once and reuse as conditions change, without rebuilding workflows

Define once and reuse as conditions change, without rebuilding workflows

Reduce operational variance without replacing judgment

Reduce operational variance without replacing judgment

Portfolio and asset-based trading, including aggregation

Portfolio and asset-based trading, including aggregation

Manage exposure with a portfolio view and plant-level precision

Manage exposure with a portfolio view and plant-level precision

Support aggregation across multiple assets within a single operating flow

Support aggregation across multiple assets within a single operating flow

Centralize oversight across positions, obligations, and submissions

Centralize oversight across positions, obligations, and submissions

Align execution priorities to commercial intent, not just process

Align execution priorities to commercial intent, not just process

Commercial optimization

Commercial optimization

Support strategy optimization that reflects real operational constraints

Support strategy optimization that reflects real operational constraints

Help reduce imbalance exposure through volume and submission optimization

Help reduce imbalance exposure through volume and submission optimization

Improve commercial outcomes by standardizing how teams apply data

Improve commercial outcomes by standardizing how teams apply data

Alerts and operational control

Alerts and operational control

Spot submission risk early with targeted alerts

Spot submission risk early with targeted alerts

Catch execution issues with trade error warnings

Catch execution issues with trade error warnings

Keep oversight with approvals, confirmations, and structured notifications

Keep oversight with approvals, confirmations, and structured notifications

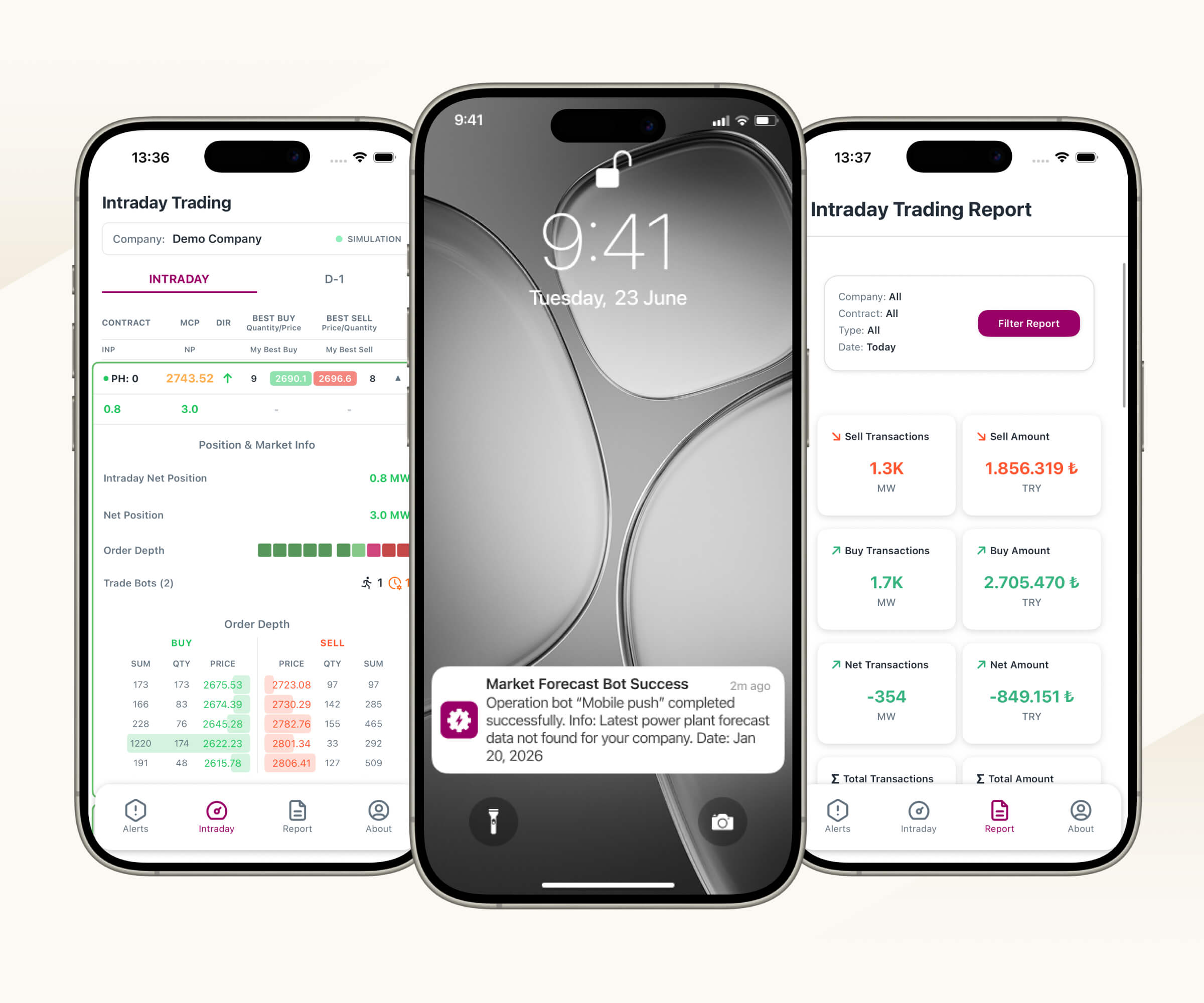

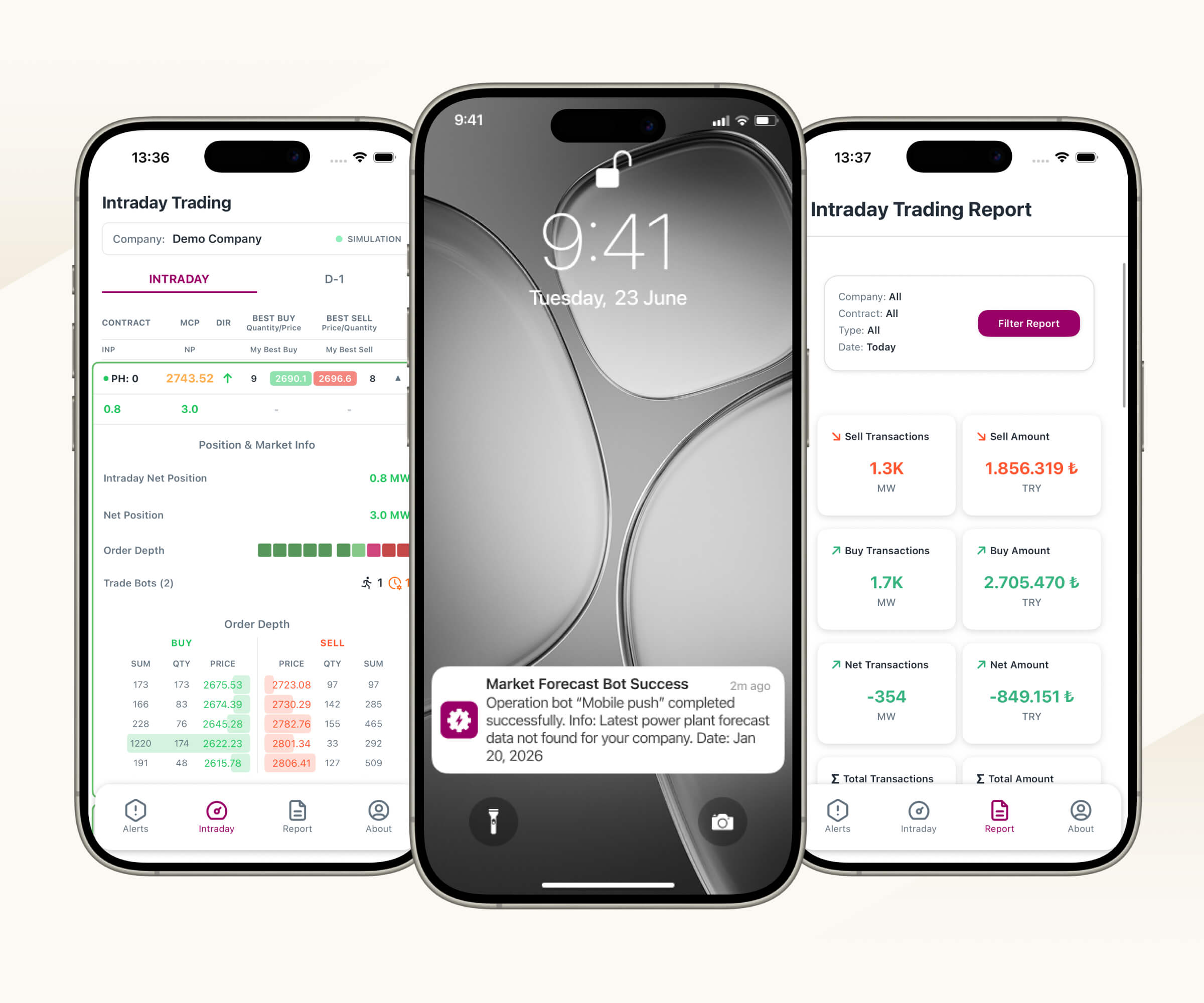

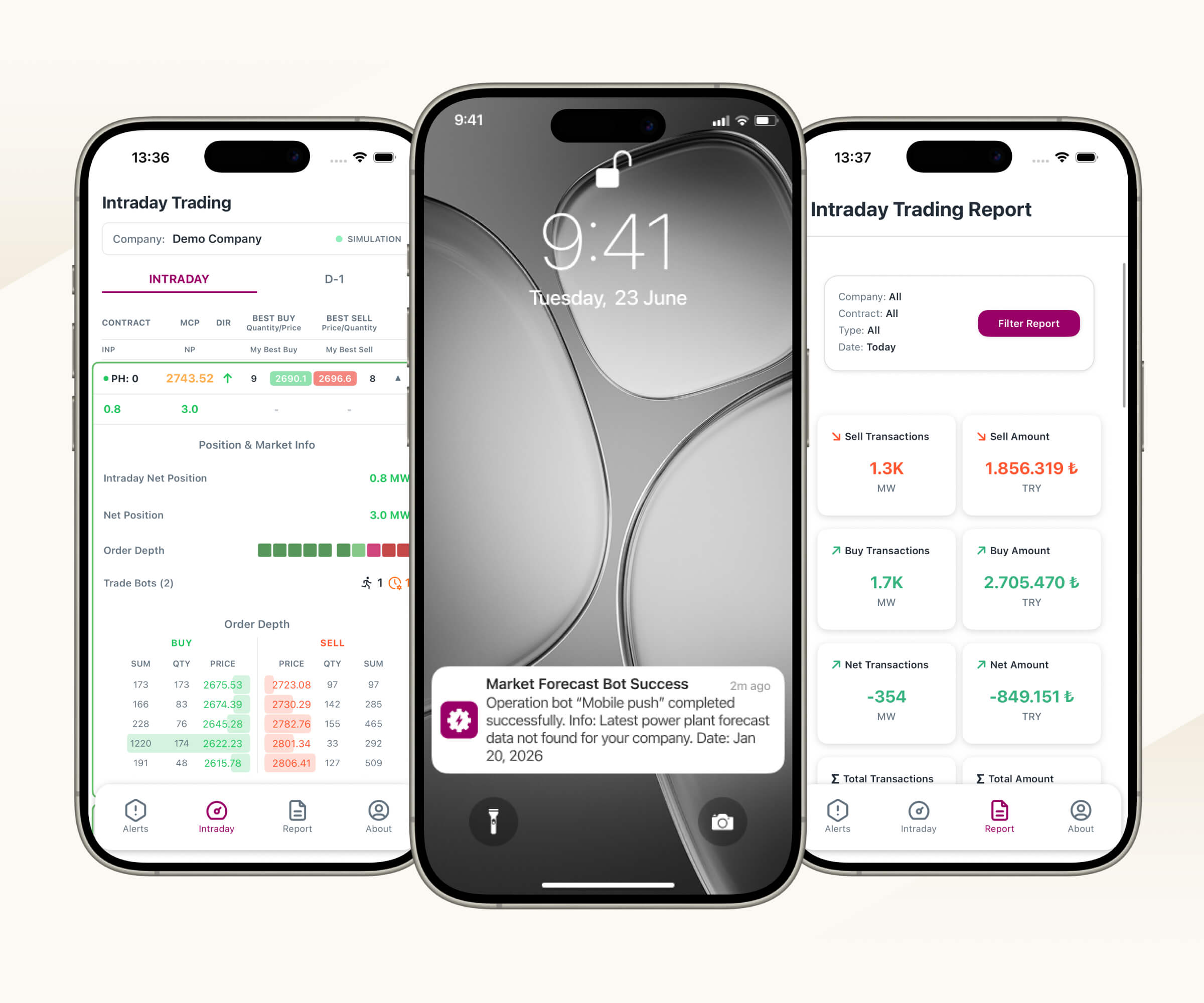

Mobile access for continuous market awareness

Mobile access for continuous market awareness

Real-time visibility into positions and operational status, beyond the desk

Real-time visibility into positions and operational status, beyond the desk

Real-time alerts for critical events and thresholds

Real-time alerts for critical events and thresholds

Secure access to key dashboards from anywhere

Secure access to key dashboards from anywhere

Designed for awareness and coordination

Designed for awareness and coordination

Seamless integration that runs alongside operations

Seamless integration that runs alongside operations

Designed to adapt across market operators, without disrupting existing workflows

Designed to adapt across market operators, without disrupting existing workflows

Connect securely with market operators and transmission system operators

Connect securely with market operators and transmission system operators

Keep positions, submissions, and operational data aligned in real time

Keep positions, submissions, and operational data aligned in real time

Build compliance-ready submissions into execution, not as a separate step

Build compliance-ready submissions into execution, not as a separate step

Maintain consistent data flows across trading systems, portfolios, and teams

Maintain consistent data flows across trading systems, portfolios, and teams

Operational support and 24/7 monitoring

Operational support and 24/7 monitoring

Continuous monitoring designed around live market realities

Continuous monitoring designed around live market realities

Early issue detection to protect continuity during critical periods

Early issue detection to protect continuity during critical periods

Direct access to operational support when required

Direct access to operational support when required

A reliability commitment that stays close to trading and balancing operations

A reliability commitment that stays close to trading and balancing operations

STAY COMPLIANT WITHOUT SLOWING DOWN

STAY COMPLIANT WITHOUT SLOWING DOWN

OnePact Monetize treats regulatory requirements as part of the operating model, not a separate burden. It helps teams keep control, improve efficiency, and stay disciplined on imbalance management in real time, while responding faster within shorter decision windows.

OnePact Monetize treats regulatory requirements as part of the operating model, not a separate burden. It helps teams keep control, improve efficiency, and stay disciplined on imbalance management in real time, while responding faster within shorter decision windows.

OnePact Monetize treats regulatory requirements as part of the operating model, not a separate burden. It helps teams keep control, improve efficiency, and stay disciplined on imbalance management in real time, while responding faster within shorter decision windows.

OnePact Monetize treats regulatory requirements as part of the operating model, not a separate burden. It helps teams keep control, improve efficiency, and stay disciplined on imbalance management in real time, while responding faster within shorter decision windows.

OnePact Monetize treats regulatory requirements as part of the operating model, not a separate burden. It helps teams keep control, improve efficiency, and stay disciplined on imbalance management in real time, while responding faster within shorter decision windows.

OnePact Monetize treats regulatory requirements as part of the operating model, not a separate burden. It helps teams keep control, improve efficiency, and stay disciplined on imbalance management in real time, while responding faster within shorter decision windows.

Integrated tools for complex environments

Integrated tools for complex environments

Discover more

Let’s start a conversation

Fill out the form and we’ll get back to you as soon as possible.

Senkron Digital is a global technology provider delivering the OnePact Suite with AI-driven EMS capabilities, along with OT-secure CyberPact Services, to enhance performance, security, and efficiency across critical infrastructure industries. We deliver reliable and intelligent Digital Solutions that empower sustainable digital transformation.

Questions? We're here to help!

Questions? We're here to help!

Copyright © 2025 Senkron Digital

Senkron Digital is a global technology provider delivering the OnePact Suite with AI-driven EMS capabilities, along with OT-secure CyberPact Services, to enhance performance, security, and efficiency across critical infrastructure industries. We deliver reliable and intelligent Digital Solutions that empower sustainable digital transformation.

Questions? We're here to help!

Questions? We're here to help!

Copyright © 2025 Senkron Digital

Senkron Digital is a global technology provider delivering the OnePact Suite with AI-driven EMS capabilities, along with OT-secure CyberPact Services, to enhance performance, security, and efficiency across critical infrastructure industries. We deliver reliable and intelligent Digital Solutions that empower sustainable digital transformation.

Questions? We're here to help!

Questions? We're here to help!

Copyright © 2025 Senkron Digital